As the financial services sector continues its process of reinvention, a new generation of banking employees and work environments signals the dawn of a revitalized industry.

The banking industry is in a state of metamorphosis as financial institutions restructure their organization and market strategies to revitalize their customers and workforce, and compete with emerging FinTech—or financial technology—firms. To attract and enhance their customers’ user experience, the financial services sector is shifting banking practices to accommodate preferences for technology, data, and easily accessible social connections. This, in turn, is forcing financial institutions to look at how they enhance their employees’ user experience and the environments in which they work.

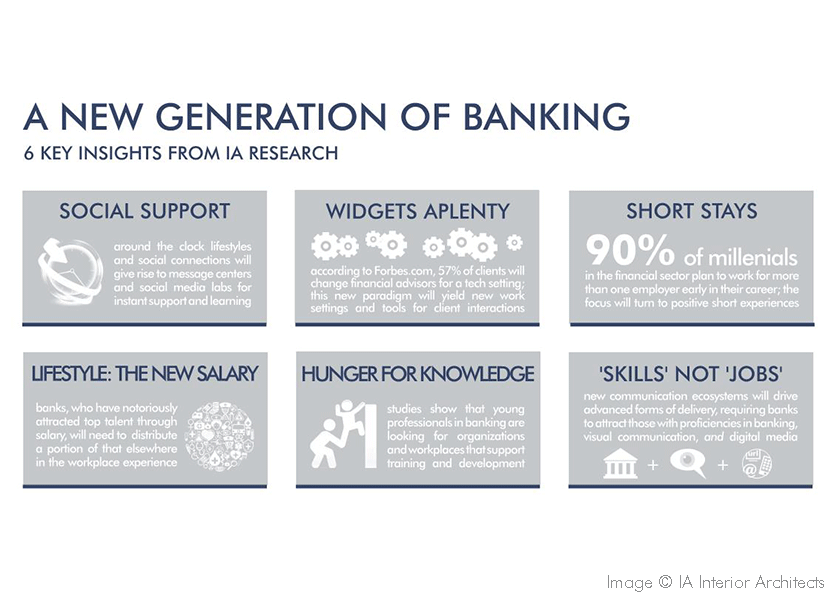

IA research has revealed six key insights into this new generation of banking in terms of how institutions attract key talent, position for new ways of working, and respond to how this has impacted the workplace.

Social Support

Ubiquitous connections, around-the-clock lifestyles, and social media require workers in the banking industry to provide immediate support to clients—and potential customers. These new functions in the workforce will give rise to new settings such as message centers and social media labs to support the instantaneous expectations of today’s customers and to be a collective learning hub for workers.

Widgets Aplenty

Technologies and gadgets will play a significant role in how new work settings will shape client interactions. A new standard of human-machine collaboration and its impact on business interactions will establish new expectations and standards of performance for workers. Younger generations will seek out employers who embrace financial technology or embrace the FinTech startup buzz to keep their skills sharp.

Short Stays

The concept of retention will become a thing of the past for employers in the context of young workplace professionals. With 90 percent of millennials planning to work for more than one employer early in their career, the focus will shift from the traditional retention of employees to creating positive, short-term experiences. This refocus is geared to sustain long-term relationships with employees for future business opportunities, as well as potential for future recruitment. Ultimately, this will place a shifting emphasis on what workplace flexibility and mobility means in response to steady turnover.

Lifestyle is the New Salary

Banking institutions have notoriously attracted top talent through competitive salary and benefits. However, with younger generations accepting lower salaries for a lifestyle that accommodates interests, such as constant connection through social media and working in a variety of places, employers must rethink recruitment strategies. In several cases, we see financial employers redistribute some of the currency feeding salaries into other employee touchpoints, including community events and the brand experience.

Hunger for Knowledge

Studies reveal that young professionals—particularly in the banking industry—are looking for organizations and workplaces that support training and development to advance their careers within the institution. The notion that millennials are constantly on the career move isn’t entirely accurate; similar to generations before, they are interested in job security that supports a healthy and socially impactful lifestyle. This desire for training leads to new models of learning in terms of when, where, and how.

Skills Not Jobs

New ecosystems of communication will drive the evolution of language—such as threading customer service conversations around a hashtag—and advanced forms of service delivery to financial institution clients. This will trigger higher expectations of what customers want to receive in terms of data-driven content and material that is easy to understand. This is also forcing well-established banking groups to partner with FinTech startups, as the demand for digital banking access continues to rise. To meet this demand, banks need to attract workers with multiple skills sets and proficiencies beyond traditional banking, which can include digital communications and software engineering. According to PwC, almost 25% of CEOs have had to cancel or delay strategic initiatives in recent years because they did not have the right talent.

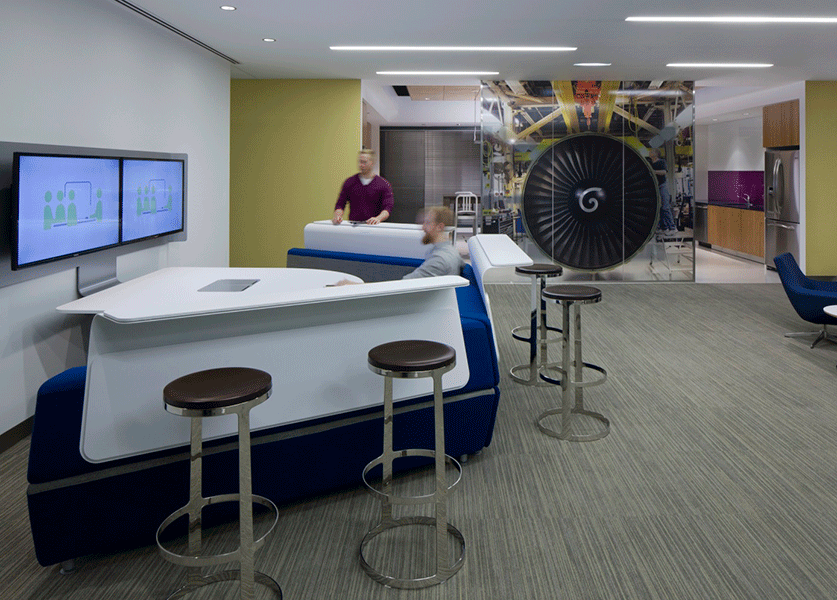

This glimpse at 21st century banking only begins to hint at how the physical workplace and the experience that comes with it will change. Innovation in both organizational strategy and workplace design will help craft the diversity and advancement the financial services sector needs for a new generation of working.